Understanding Health Insurance Costs

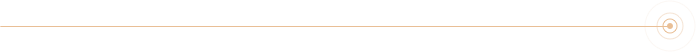

Understanding the cost of healthcare may not be straightforward. The total cost incurred by an employee or a consumer has two components:

- One is a monthly premium that is pre-determined at the time of enrolling in a health plan. It remains the same for the entire year the consumer is enrolled in the plan.

- The other is the out-of-pocket costs that cannot be pre-determined but only estimated based on the health plan’s member cost-sharing.

So, to truly understand your costs, you have to know the Expected Cost for the year which is:

12 * plan premium for your coverage tier + estimated out-of-pocket costs based on your plan design.

The premium charged by a health plan and its member cost-sharing go in opposite directions. The higher the cost-sharing, the lower is the premium.

The out-of-pocket costs are always borne by the employee, although some employers may fund them by contributing to a gap-fund plan. Employers continue to shift costs to employees by increasing member cost-sharing and inducing more accountability on members’ care utilization. By increasing the cost-sharing as part of the plan design, employers’ cost as their contribution to premium reduces.

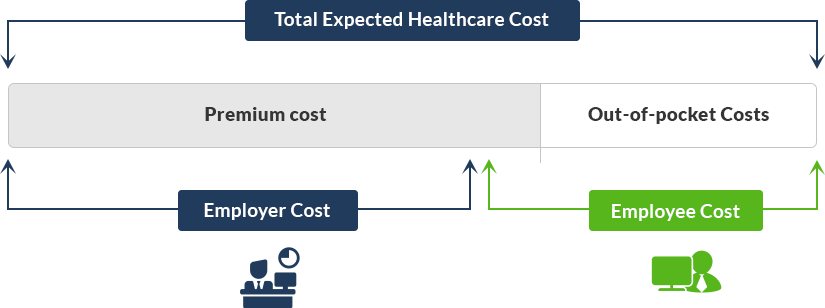

Another aspect to consider as part of the cost, the tax savings available in the case of plans that are eligible for health savings account. HSA plans provide triple tax advantage to the employees, creating savings on federal income tax, state income tax and payroll taxes on the amount contributed to the HSA account by the employee and/or employer. It reduces the employer’s payroll taxes as well.

Based on that, the cost picture would be redrawn as below.

Member Cost-Sharing or Out-of-Pocket Costs

It is important to understand the member cost-sharing and its intent. This is an out-of-pocket cost component the consumer or member is entirely responsible for. The costs incurred are in proportion to the utilization of care, subject to an upper cap. This is a means by which health plans induce consumer accountability for the right and need-based use of care. Sometimes employers may subsidize the member cost-sharing by contributing to the employee’s gap-fund arrangements such as HSA or HRA accounts. It is called gap-fund because it is a gap between what the health plan is willing to pay and what the actual healthcare cost is.

See the benefitsEZ’s resource material to understand more about the gap funds and what strategies the employers can use to take the best advantage of them.

The cost-sharing is implemented in a plan through the following avenues.

Copay

A copay or copayment is a flat fee the consumer is responsible to pay at the point-of-service location such as the provider’s office or a prescription drug store. Typically, services that cost relatively lower such as a physician or specialist visit, urgent care, outpatient rehab therapies, etc. involve copay.

Are there services or circumstances that do not require copay?

- The consumer does not have to pay a copay fee for certain preventive care services (e.g. annual checkups, child immunizations, mammograms, women’s health, etc.). Or if the consumer has already reached the Maximum Out-of-pocket limit, then there is no copay for any services. The copays are counted towards the maximum out-of-pocket limit.

- Most services requiring the payment of copay waive the deductible. However, there may be services where the member is required to copay after the deductible is met. For example, outpatient short-term rehabilitation therapies involving speech, physical, occupational, etc. may involve a copay payment after the deductible. Until the deductible is entirely met, there is no copay.

- A copay service in a High Deductible Health Plan that is eligible for HSA may require that the aggregate deductible is met before copays come into the picture.

What are copay amounts in a typical plan?

- A plan with a $10 or $15 copay can be considered as a rich plan.

- Copays for a specialist visit can be $15 at the lower end, and they can go as high as $70.

- Sometimes the copay for certain services such as urgent care may be $20 or $50 per visit and emergency care may be $100 or $200 per visit.

- Sometimes the copay may be exempted for the first few physician visits.

- Plan designs use copay as a disincentive to using certain services such as non-emergency care in an emergency room. Sometimes they are used to promote certain uses. For e.g., $0 copay if you use a free-standing testing lab vs. $500 copay if you use the testing lab attached to the hospital

How is it paid or billed?

- Copays are collected at the point-of-service location and so they are not billed. However, if the payment was missed for some reason, the provider may send a bill.

- If the consumer has an FSA or HSA debit card, copays can be paid using the card at the service location.

Deductible

A deductible is a first-dollar expense incurred by the member when consuming those services that are subject to deductibles. These would be typically high-cost services such as inpatient hospitalization, outpatient surgery, complex imaging services such as MRI, PET, CT scans.

A deductible is defined for a single individual and for the family as a whole. Each covered member’s deductible usage is tracked separately and the family deductible if applicable is used as an overall cap to the requirement of meeting deductible.

For example, in a family of 4, in a plan that has $1000 / $2000 as individual and family deductible, each covered member’s use of deductible services is subject to the $1000 cap, while collectively they are subject to $2000 cap. This is how normally an embedded deductible works in most plans.

HSA eligible plans mostly employ aggregate deductibles where the deductible usage is measured for the family as a whole when the covered members are more than a single individual. When there are two or more individuals covered in a family plan, the individual deductible has no purpose if it is an aggregate deductible.

Copays do not count towards the deductibles in most cases. Most services use one or the other, although some services have both. The deductibles get counted into the annual max out-of-pocket limit that serves as a consumer protection cap both at an individual level and at the family level.

Are there services or circumstances that do not require deductible?

- Services that are copay based where deductible is waived.

What are deductibles in a typical plan?

- A $0 deductible or $500 deductible plan is generally a rich plan.

- Plans are increasingly adopting $1000 to $1500 deductibles.

- In the case of HSA eligible plans, a minimum of $1300 single and $2600 family deductible is required. Certain catastrophic plans use $5000 single deductible.

How is it paid or billed?

- The exact deductible amount generally may not be determined at the point-of-service location in the case of medical services. They are billed by the Provider’s office, after the claims are adjudicated by the health plan.

- Sometimes, certain health plans make it easy for the consumers to pay these amounts through their portal or a third party service.

Coinsurance

Coinsurance is a portion of the medical cost the consumer is responsible to pay. Coinsurance comes into the picture typically for high-cost services after the deductible is met by the consumer.

Plans that have 0% coinsurance do not require the consumers pay anything after the deductible is met. If there is a coinsurance of 20%, then the members have to pay 20% of the amount remaining after meeting the deductible of the contracted fee for the service.

For instance, if a plan has a $2000 deductible and 20% coinsurance, in a scenario of a childbirth that may cost $20,000 contracted fee with a network provider, the consumer will be required to pay $2,000 as deductible + $3,600 as 20% of 18,000, amounting to a total of $5,600, provided the max out-of-pocket limit here is above $5,600.

Coinsurance amounts count in towards the annual maximum out-of-pocket limit as consumer protection.

What are coinsurances in a typical plan?

- Most plans have 100% coinsurance meaning, the consumer does not have to pay any coinsurance (0% coinsurance from a consumer perspective) after the deductible is met.

- Other values go 90%, 80%, 75%, 70% etc. When the coinsurance increases, typically the gap between deductible and maximum out-of-pocket limit also increases.

- A slight increase in co-insurance (from a consumer standpoint) can reduce the premium, as the healthcare cost is further shared by the member.

How is it paid or billed?

- Just as deductibles, the exact coinsurance amount is not determined at the point-of-service location. They are billed subsequently. Health Plans provide an Explanation of Benefits statement.

Premium Cost

It is good to understand broadly how premiums are determined by the health plans or insurers.

Premium is the amount charged per month by the health plan or a TPA who is providing the services. Premium amount is computed for every tier of coverage (typically four-employee only, employee and spouse, employee and children, employee and family – although can be different) offered by the employer and it remains the same for a 12-month period.

It is an outcome of underwriting the risk level of an employer and their covered population. There are many factors that influence the underwriting process, such as the demographics of the covered population that include the employees and their families.

Some of the factors considered are:

- County/zip code of the employer and employees

- SIC code of the employer (industry classification)

- Age brackets

- Male to female ratio

- coverage tier counts such as employee-only vs family and

- Large loss claimants beyond a specific amount (e.g. > $5000)

- Employer’s contribution to gap-funds (HSA/HRA etc.)

- Plan design’s member cost-sharing (copay/deductible/coinsurance)

- Cost containment programs adoption

Once the risk level of an employer is determined, the actual premiums are computed by applying the relative factors to the base rates setup for various plan designs that have varying degrees of member cost-sharing.

Fully Insured Plans with fewer than 50 employees (ACA Plans)

In the case of ACA Plans, the process is driven by a community rating system that does not custom underwrite employers with 50 or fewer employees. The community rating system uses an age band rating methodology that has pre-determined and pre-approved rates for each quarter for different ages or age brackets in each county. The specific claims experience or utilization level of an employer is not relevant in this system as the risk is estimated at a broader community level. Just the demographics information of county and age will drive the premium calculation for each covered person for a specific employer population.

Fully Insured Plans with more than 100 employees

In the case of firms with 100 employees or more, the specific claims experience of the employer is generally made available to the company by their current carrier. Such claims experience and its credibility is evaluated in the underwriting process to arrive at a premium for the coverage tiers that can cover the estimated risk level

Level-funded Plan (5 or more employees to 100 or 250 employees) / Self-funded Plan (100 or more employees)

In the event of level-funded or alternatively funded plans which are technically a variation of the self-funded plans, the carriers do not have to go by the community rating system, instead, they could custom underwrite even smaller firms. Generally, a minimum of 5 employees is needed for most level-funded plans.

The level-funded plans follow a process similar to applying claims experience wherever possible or manual underwriting that is based on gathering health history data directly from the employees. Alternately, some carriers simplify this process by estimating the risk through past pharmacy utilization data of the employees that are available.

Claims experience must be made available to smaller firms as well in the state of TX due to its particular state legislation Texas H.B. 2015. In such cases, this information is needed in the underwriting process.

A deeper understanding of Premium

If the plan is a fully insured plan, the employer does not get visibility into the breakdown of the premium amount. The employer does not get visibility into how the premiums are spent to pay claims and administer the plan. However, employers with more than 100 employees generally get aggregate claims and large loss claims experience reports, that provide some understanding of how they are doing and the rationale for any renewal increase. There are exceptions to this such as even small employers in TX can obtain claims reports.

If the plan is either a level-funded plan (variation of self-funded managed entirely by the carrier or TPA to make it look like fully insured from the employer’s perspective) or a self-funded plan, then generally, the breakdown of premium is provided to the employer.

Premium = Fixed Cost + Maximum Claims Funds Cost

Fixed Cost

Fixed Cost includes the cost of administration and services, stop-loss premiums.

Administration and services may include claims administration, network fee, pharmacy benefits manager fee, disease and utilization management, preventive care programs, member outreach, and other programs etc.

Stop-loss premiums include a premium for claims exceeding the Individual Stop Loss (ISL) limit, and premium for aggregate claims exceeding the maximum liability (Aggregate Stop Loss). ISL may be alternately called Specific Excess Loss.

ISL Premium

The carrier or the TPA reinsures the payment of individual claimants that exceed a certain limit defined as ISL Deductible. This can be $50,000 or $85,000 or $20,000 for smaller employers). The higher the ISL limit amount, the lesser the stop-loss premium charged by the Stop-loss carrier who is a reinsurer.

The stop-loss carrier estimates this based on assessing specific large losses, assessing and predicting the likely usage of treatment plans (e.g. cancer treatment) that may be in progress.

In certain circumstances, a specific single claimant may be excluded from this stop-loss coverage and that may have to be covered from the claims funds. Such limitations or lasers are identified and defined ahead of time. The idea here is to treat such as outliers so that they do not impact the premium of the larger population.

ASL Premium

The carrier or the TPA reinsures the payment of aggregate claims that exceed the maximum liability funds, which is already 25% excess of expected claims. This excess factor called aggregate corridor can be sometimes only 10% in the case of smaller firms.

Maximum Claims Funds Cost

Maximum Claims Funds Cost is 25% excess of annualized expected claims cost to sufficiently fund all claims with the exception of claims exceeding the ISL limit. The annualized expected claims cost is determined based on the past aggregate claims incurred with certain trend factors and weightage factors.

What is Life Insurance?

What is Life Insurance?Life insurance is a contract that you enter into to ensure that your loved ones are financially protected in the event of your death. The contract states that, upon your death, the insurance company will pay a specific amount of money to your...

What is an HRA?

What is an HRA?HRA is a Health Reimbursement Arrangement, a tax-free fund solely funded by the employer to cover employees’ medical expenses. HRAs may be offered along with other employer-provided benefits such as the FSAs or High Deductible Health Plans. Employers...

What is an HSA?

What is an HSA?HSA is a Health Savings Account, a tax-exempt account funded by the employee or the employer to cover the employee’s out-of-pocket medical expenses. HSAs must accompany a corresponding High Deductible Health Plan (HDHP). A Limited Purpose FSA to cover...

HRA, HSA, FSA Health & FSA Limited Purpose

HRA, HSA, FSA Health & FSA Limited PurposeComparing the tax-advantaged gap funds that help to manage the healthcare services and qualified medical expenses. Use this chart to determine which one would be most fitting to your employees and your needs.

Guidance for Employees to Choose a Medical Plan

Guidance for Employers to Choose the Right Set of Medical PlansMost employers offer a choice of three or four medical plans in the employer-sponsored insurance market. Some smaller employers may offer just two plans or sometimes a single plan with no choice. These...

Guidance for Employers to Choose the Right Set of Medical Plans

Guidance for Employers to Choose the Right Set of Medical PlansPlease review the Understanding Health Insurance Costs topic prior to reviewing this material. Knowing the costs helps you make better decisions. Factors that play role in this decision process: Plan...